The NAR Settlement Backfired: Why Commissions Are Rising in Chicago

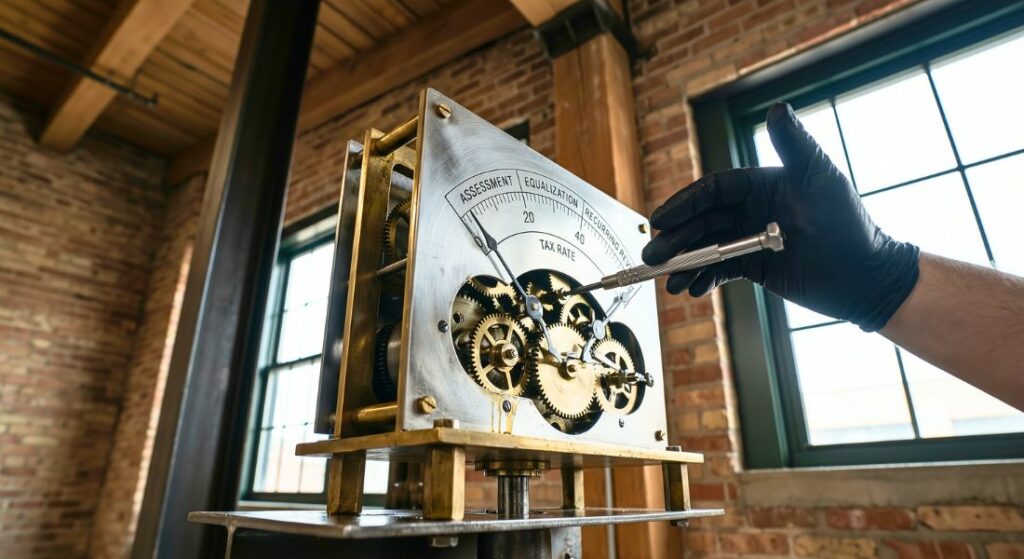

For months, buyers and sellers had heard that the NAR settlement would make housing more affordable by lowering the cost to buy/sell a home, including slashing commissions. Instead, an emerging pattern in Chicago and nationwide suggests something very different.

In many deals, the NAR settlement does not lower costs. It is reshaping leverage, and leverage is quietly pushing commissions higher.

That surprises a lot of people. The headlines sounded simple, but reality on the ground does not.

The settlement landed in a complex environment where things don’t always unfold as expected.

The Real Result of the NAR Settlement

The early narrative sounded clear: sellers would stop paying both sides, and buyer agent fees would be decoupled and borne by the buyer. Transparency would drive commissions down over time.

In practice, many Chicago listing agents now quote higher listing-side fees. Many buyer agents ask for more compensation, not less.

Before the settlement, listing agents routinely offered compensation to buyer agents in the MLS. That structure kept expectations clear.

Once you remove that built-in pathway, you create a new question in every deal: who will pay the buyer agent, and how much?

Agents Needed to Compensate For the New Rules

In this new environment, sellers hear a simple message: you only need to pay the buyer agent if there is room in the deal. Listing agents understand the message and adjust accordingly. Instead of quoting something like 2.5 percent, many now position at 3 to 3.5 percent. They know they might need flexibility to solve buy-side compensation later.

At the same time, buyer agents now claim to have to work harder and now have greater uncertainty about how and when they are paid. Many respond by asking for 3-3.5 percent, not 2.5 percent. That’s because they are assuming more compensation risk – something the NAR settlement never contemplated.

Chicago Does Not Follow the National Story

Chicago is a hyper-local, attorney-heavy market where representation does not feel optional to most consumers. Buyers still want help with comp-based pricing, inspection strategy, negotiations, and sequencing. Even highly educated buyers often decide they do not want to manage that alone.

Sellers, in turn, understand how fragile a deal can feel during attorney review and inspection. Many do not want to shrink their buyer pool by refusing to offer buyer-agent compensation. They worry about fewer showings, weaker offers, and longer days on market.

What Chicago Buyers Need to Know About Representation

For buyers, one big shift is simple: your agent’s fee is no longer quietly “baked in” behind the scenes. It needs a plan. You now see it in writing, often on the buyer agreement and sometimes directly in the offer structure. In many cases, your lender, agent, and attorney will coordinate to fold that fee into your overall strategy.

That makes your agent’s skill set far more important than a quick “what do you charge” question. Cheap representation can cost you more in missed available non-public inventory, poor inspection strategy, weak negotiations, and avoidable delays.

Buyers should also understand the three main compensation paths that keep showing up in current Chicago deals. In some cases, the seller still covers the buyer-agent fee outright. A second path involves the buyer financing that fee within the mortgage by adjusting the price and terms. In a smaller but growing number, the buyer pays part or all of the fee out of pocket. A great agent walks you through those options early, with simple math, so you feel prepared.

What Chicago Sellers Need to Know About Pricing Power

For sellers, the temptation is clear: if you avoid offering buyer-agent compensation, you might think you save money. In practice, you often narrow your buyer pool. Some buyers cannot or will not pay their agent directly, even if they love your property, and they will opt for a property where the seller is offering buyer agent compensation.

At the same time, many listing agents now build in a higher listing-side commission to offset these concerns. The point is not to pay more just for the sake of it. You buy leverage in a slower, more tactical market. The right commission structure functions like an investment in stronger offers, faster sales, and a greater chance of getting to closing.

Two Buyers, Two Outcomes

Imagine two Chicago buyers looking at the same condo at the same price point. Both earn similar incomes and are preapproved for the same amount.

One works with an experienced buyer agent who explains compensation paths on day one. The agent coordinates with a lender and scripts how to present the offer so the seller feels seen and respected.

That agent anticipates the seller’s concern about covering the buyer’s fee and proposes a slight price adjustment. They structure the deal so that the net to the seller remains attractive.

The second buyer works with an agent who avoids the fee conversation until they fall in love with the condo. That buyer then discovers they cannot easily pay out of pocket. The agent tries to fix it on the fly, the seller feels frustrated, and the offer looks messy next to competing bids.

In many cases, the first buyer wins the property, and the second buyer never knows how close they came.

Experience Commands a Premium in Chicago

The settlement added a new layer of complexity to a market that already required strong attorneys, informed agents, and careful coordination. Complexity usually rewards experienced professionals who can simplify decision-making. Top agents, local specialists, and established negotiators now spend more time on expectation-setting.

As a result, those professionals often command higher fees, but the market increasingly sees them as an asset rather than a cost. They help buyers and sellers avoid missteps that can waste months or erode tens of thousands of dollars in value by blindly accepting offers that will never close.

Chicago Commission FAQs

Are Chicago and nationwide commissions actually higher after the settlement?

They are in many cases. Especially where agents build in more protection against uncertainty around buy-side fees. Listing-side rates often tick up, and buyer agents frequently ask for more than before.

Can buyers still get representation without paying out of pocket?

In many Chicago transactions, buyers still structure deals so the seller covers some or all of the buyer-agent fee. In others, buyers finance the fee within the mortgage. Out-of-pocket payment exists, but it remains one option among several, not the only path.

Will commissions drop again once the market adjusts?

They might shift as buyers, sellers, brokers, and attorneys grow more comfortable with the new rules. For now, the transition period creates uncertainty, and uncertainty often leads to premium pricing for skill and experience.

What if I want to negotiate my agent’s fee?

You can always have that conversation. Focus on the full scope of service, not just the percentage. Many agents feel flexible when they see a clearly motivated client and a realistic plan. Others hold firm because they know from experience that their time and dollar investment will be higher than average.

Experienced Guidance in Chicago Real Estate

Chicago’s early response to the settlement highlights a broader truth. When rules change without simplifying execution, the market compensates by paying for experience. In Chicago, that shift elevated professionals who can manage complexity without friction.

The best outcomes in this new environment come from clarity and preparation. Connect with MG Group to start a conversation about navigating this changing market.