The Hidden Curve Behind Condo HOA Costs

Most condo buyers focus on today’s assessment. Smart buyers focus on tomorrow.

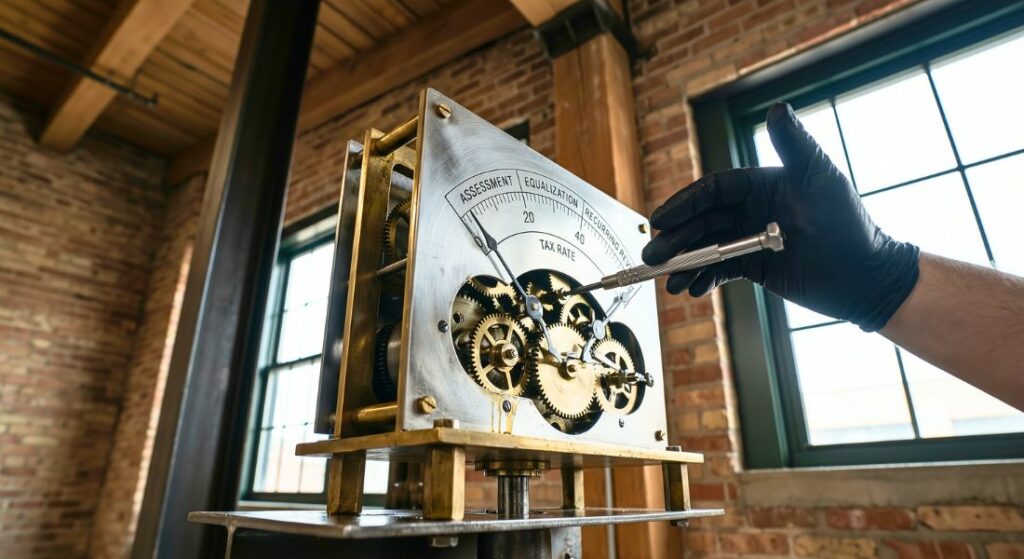

In Chicago, condo HOA costs rarely come out of nowhere. They build quietly over time. The costs may hide in reserve balances, future project notes, and assumptions baked into budgets that few people read closely before closing. By the time a special assessment appears, the math has usually been clear for years.

Understanding the HOA cost curve changes how buyers evaluate value and how sellers protect leverage. It turns assessments from a guessing game into a measurable forecast.

HOA Costs Can Mislead Buyers At First Glance

Monthly assessments feel like an easy metric. Simple math tells you that lower must be better. That logic fails far more often than it works.

Low assessments can signal efficiency, strong reserves, and disciplined planning. They can also signal deferred maintenance, underfunded reserves, and boards that delay hard conversations.

High assessments can reflect financial stability, recent capital improvements, or proactive reserve funding. They can also reflect emergency spending or projects already underway.

Without context, the number itself tells you almost nothing. What matters is how the association plans, saves, and executes over time.

Start Asking the Right Questions

Experienced agents and attorneys do not skim condo documents. They interrogate them.

They look for answers to three core questions:

- What work is planned?

- How will the association pay for it?

- Does the math actually work?

Answering these questions shows how the building will handle future expenses. This knowledge gives buyers a measurable sense of risk.

The Condo Documents That Predict Future Expenses

Those answers usually live in three places:

- The Operating Budget: This document shows how the community manages money today. It reveals whether the association prioritizes reserves or treats them as optional.

- The Reserve Study: If one is available, it’ll cover long-term capital needs for roofs, masonry, elevators, and mechanical systems.

- Board Minutes: The board minutes and official communications often reveal what the budget avoids saying directly. They show debates, postponed projects, and early warnings that never make it into marketing language.

If these documents align, future HOA costs become predictable. If they contradict each other, risk rises quickly.

Don’t Consider Reserves Optional

A healthy condo association behaves like a business, not a reactionary committee.

That means it plans for predictable expenses, schedules capital improvements before failure, and contributes to reserves every year.

When budget reserves are low or exhausted, two outcomes are likely. Lenders will start asking questions, and special assessments will become inevitable.

That is not pessimism. It is arithmetic. That’s why reserve strength often matters more than current monthly cost.

When Buyers Recognize Reality Too Late

Imagine a mid-rise Chicago condo building built in the early 2000s. The assessments look attractive compared to nearby buildings. Buyers feel confident. Units sell quickly.

The board has discussed masonry repairs for years, but never commissioned a full study. Elevator modernization keeps getting postponed. Reserves sit well below recommended levels, but no one wants to raise dues.

Five years later, multiple systems reach the end of their useful lives simultaneously. Engineers confirm the work cannot wait. Bids arrive higher than expected due to inflation and labor costs.

The board has no choice. It issues a large special assessment and significantly increases monthly dues to rebuild reserves.

Owners feel blindsided, but the warning signs existed long before. The documents told the story quietly. Most of them just didn’t look deep enough.

Why Lenders Pay Closer Attention

Buyers are often willing to overlook a little uncertainty, especially if they really like the unit or the building. Lenders must follow hard rules and federally mandated guidelines.

Weak reserves or unrealistic budgets can trigger underwriting conditions, delay approvals, or eliminate certain loan programs. In some cases, only cash or portfolio loans remain viable.

When financing options shrink, demand shrinks with them. Prices follow.

That is why HOA costs influence value even when owners never plan to sell. Financing drives market health, and market health depends on predictable association finances.

The Mistake the Costs Sellers Leverage

Many sellers and some agents wait to review condo documents until after accepting an offer. That approach can create unnecessary risk but review must happen before closing the attorney review period.

Experienced listing agents know to gather budgets, disclosures, and insurance information early. They read them before going live. These agents anticipate buyer and lender concerns rather than react to them mid-transaction.

When reserves are low, sellers can plan credits, price adjustments, or strategic timing. If upcoming projects exist, transparency builds trust.

What Buyers Should Confirm During Attorney Review

Attorney review is not just legal protection. It is financial due diligence.

Buyers should find out:

- Whether major projects are already funded.

- Whether bids exist for planned work.

- Whether reserves align with the building’s age, size, and complexity.

If an association plans work but has not priced it, that is not a plan. It is a placeholder.

Clear funding timelines reduce risk. Vague intentions increase it.

Special Assessments are Normal

Special assessments happen, especially in older Chicago buildings. They are not inherently a red flag.

What kills deals is discovering them late or learning that the HOA discussed them for years without action.

Transparency preserves value. Ambiguity destroys it.

When buyers understand the why and the when, they can price risk rationally. When they do not, fear takes over.

How Experience Changes the Outcome

Seasoned professionals recognize patterns quickly. They spot elevator buildings without a reserve runway and recognize aging masonry without capital planning.

Experience does not eliminate HOA costs. It helps buyers and sellers account for them early, rather than reacting emotionally later.

Midway through any condo search or sale, questions about future expenses usually surface. That is often the right moment for a calm, informed conversation.

FAQs About the HOA Cost Curve

How much should a condo association keep in reserves?

There is no universal number, but many studies suggest that associations aim for at least roughly 70 percent funded reserves over time. The right level depends on building age, size, and complexity. What matters most is whether reserves align with known future projects. Lenders expect to see 10% of annual HOA income to be set aside for reserves but buyers are taught to look for around $2,000/unit in reserves.

Are low HOA fees always a red flag?

Not always. Some buildings operate efficiently with strong reserves and minimal amenities. Low costs become concerning when they coincide with deferred maintenance or nonexistent reserve funding.

Do lenders review condo reserves?

Yes. Lenders often review budgets, reserve balances, and financial statements during underwriting. Weak reserves can lead to loan restrictions or denial. It affects resale value and market demand.

Can sellers fix reserve issues before listing?

Sellers cannot change years of financial history, but they can prepare. Transparency, realistic pricing, and strategic credits often preserve deals. Preparation matters more than perfection.

What documents matter most during attorney review?

Operating budgets, reserve studies, board minutes, and disclosures matter most. Together, they show how the association plans, spends, and communicates. Missing or vague documents increase uncertainty.

Does building age automatically mean higher HOA costs?

Older buildings often face higher capital expenses, but age alone does not determine risk. Planning, reserves, and maintenance history matter more than the year built.

Understand HOA Costs Before You Buy

HOA costs do not spike randomly. They follow a curve shaped by planning, honesty, and discipline. If you understand that curve before buying, assessments become predictable.

In condo ownership, the future bill is written long before it arrives. The only question is whether you notice it in time.

MG Group is here to help you interpret condo documents and assess HOA costs. Reach out now for help buying or selling a condo in Chicago.