Litigation Doesn’t Have to Kill Your Chicago Condo Deal

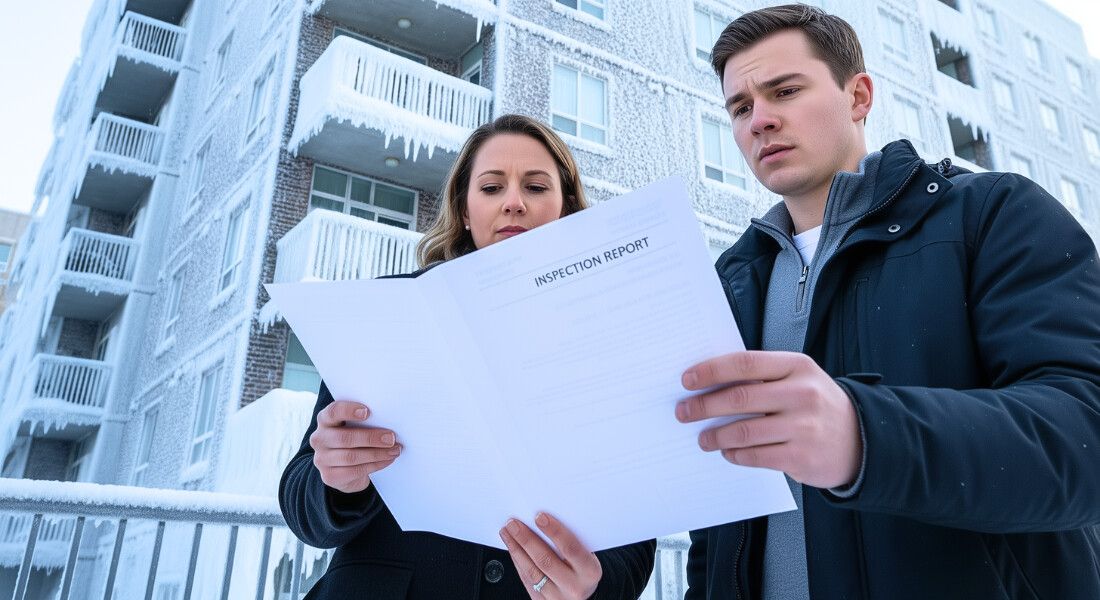

Most buyers think condo risk lives inside the unit. You’re checking out the appliances and the finish. You assume the physical inspection says it all.

In reality, the greatest risks often sit outside the drywall. Lawsuits, governance failures, and lender red flags can quietly turn a “great condo” into an unfinanceable asset.

In Chicago, one unresolved legal issue at the building level can stop financing in its tracks. When that happens, values do not drift down slowly. They lock up.

That is where many buyers and sellers get blindsided. They focus on the unit, while lenders focus on the building. Understanding that distinction is the difference between a smooth closing and a deal that collapses weeks before the finish line.

Why Condo Lawsuits Freeze Buildings So Quickly

Lenders do not underwrite condos the same way they underwrite single-family homes. A single-family home stands on its own. With a condo, the lender evaluates the entire association first, then the individual unit.

If a condo association is an active party to a lawsuit, many lenders will simply say no. Not maybe. They won’t issue the loan with more conditions. Just no.

The reasoning is straightforward. Litigation creates uncertainty. Uncertainty threatens collateral value. Lenders do not get paid to take that risk.

Lack of Financing Shuts Off Demand Overnight

When lenders pull back, the buyer pool shrinks fast and becomes limited to CASH ONLY buyers.

Owner-occupants rely on conventional financing. FHA, VA, and portfolio loans also have strict litigation guidelines. When those options disappear, buyers disappear with them.

The result is predictable. Listings stall and days on market climb. Sellers slash prices, not because the units are bad, but because financing is unavailable.

That’s a measurable value loss that has nothing to do with the quality or condition of the unit. It’s all about liquidity.

Lawsuits Can Turn Owner-Occupied Units Into Rentals

When financing dries up, the remaining buyers tend to be cash investors.

Cash buyers gain leverage. Owner-occupants step back. Investor demand replaces residential demand.

Over time, buildings that were intended to be owner-occupied shift toward rentals. That is not a strategic decision by the association. It is a reaction to market pressure.

Once rental concentration increases, financing becomes even harder. Many lenders cap investor ratios. That creates a feedback loop that can suppress values for years.

Not All Condo Lawsuits Are Equal

Here is the part many agents and buyers miss. Not all lawsuits carry the same risk in the eyes of lenders.

Lenders care about scope. A construction defect lawsuit tied to building envelope issues carries greater weight than a boundary dispute or an insurance subrogation claim.

They care about status. Early-stage, open-ended litigation signals uncertainty. A case nearing settlement signals resolution.

Lenders care about remediation. Is the issue already being fixed? Does the community have funding in place? Are special assessments defined?

Context matters as much as the lawsuit itself.

The Overlooked Solution

Deals do not always die because of a lawsuit. Some die because no one explains it.

When the risk is clearly defined, scoped, and supported by documentation, lenders often stay in the deal. When the risk is vague, they walk.

That is where preparation becomes everything. The right paperwork can preserve financing even when litigation exists.

The Attorney’s Letter That Unlocks Financing

One of the most effective tools in these situations is a formal letter from the condo association’s attorney.

This letter should clearly outline what the lawsuit is about, where it stands procedurally, and why they expect a resolution. It should also explain what corrective work is underway or planned and whether the condo building’s insurance provider is covering the cost of the repairs/judgement/legal fees.

A strong letter reframes the risk from unknown and open-ended to defined and managed.

For lenders, that difference matters. Loan officers are not looking for perfection. They are looking for defensibility. These professionals need something they can put in the file, send to underwriting, and justify internally.

A Common Chicago Real Estate Scenario

Imagine a buyer under contract in a well-located Chicago mid-rise. The unit checks every box. The inspection is clean, and the appraisal comes in at value.

Then, underwriting flags active litigation related to water intrusion from the exterior facade.

Without context, the lender denies the loan. The deal looks dead.

The association attorney provides a detailed letter stating that the lawsuit is against the original developer. It explains that remediation work is already funded by insurance proceeds and that repairs are scheduled for completion within 6 months.

The lender resubmits the file. Underwriting approves the loan with no additional conditions. The deal closes. Getting ahead of the issue BEFORE the initial lender denial is the best way to handle this – and experienced agents know this.

Nothing about the building changed. Only the story did.

When Documentation Cannot Save a Deal

This strategy is not magic. Timing matters.

If a lawsuit is brand new, adversarial, or lacks a defined remediation plan, no letter will save the transaction. In those cases, the risk is real.

Buyers should walk. Sellers should adjust expectations. Pretending otherwise only leads to late-stage failures.

What Buyers Should Verify Before Making an Offer

Before falling in love with a condo, buyers should ask questions about the building, not just the unit. Key questions include:

- Is the association involved in any active litigation?

- Have recent sales closed with financing?

- Are lenders currently active in the building?

- If litigation exists, is there documentation explaining it?

If those answers are unclear, you are not evaluating a unit. You are gambling on a building.

What Sellers in Litigated Buildings Must Do

Sellers do not control lawsuits, but they do control preparation.

Smart sellers gather association documents early, understand the legal posture, and coordinate with counsel before listing.

Waiting until underwriting discovers the issue is how deals die a slow, painful death. Proactive preparation preserves leverage and protects timelines.

Why Experience Matters in These Deals

Condo litigation is not a niche issue in Chicago. It is a recurring reality in dense urban buildings.

Agents who understand how lenders think, how underwriters assess risk, and how documentation flows through the loan process create outcomes that others cannot.

It is not about pushing deals through. You need to structure them correctly from day one.

Your Questions Answered

Can you get a mortgage in a condo with active litigation?

You can under the right circumstances. It depends on the type of lawsuit, its stage, and whether remediation and funding are clearly defined. Broad uncertainty usually triggers denial.

Do all lenders treat condo lawsuits the same way?

No. Some portfolio lenders have more flexibility, but most still require clear documentation. Assumptions without paperwork rarely survive underwriting.

Will cash buyers always get better deals in litigated buildings?

They often do. Reduced competition gives cash buyers leverage, but it does not mean the building lacks long-term value.

Can a lawsuit affect my ability to refinance later?

Absolutely. Even if you buy with cash, future financing can be blocked until the issue resolves.

Should sellers disclose litigation upfront?

Yes. Transparency protects credibility and reduces late-stage fallout. Surprises kill deals.

A Team That Understands Litigation Risk

In condo deals, the unit sells to the buyer. The building sells to the lender.

If you are navigating a condo purchase or sale involving litigation in Chicago, preparation and clarity are everything.

At MG Group, we help buyers and sellers evaluate building-level risk before it derails the deal. Contact us for support that can help you succeed in the most complex real estate transactions.