Why AI Pricing Fails in Chicago: The 5–10% Gap Only Human Brokers See

Chicago real estate rewards nuance. AI pricing cannot keep up with the city’s complexity.

Automated tools can provide approximate values in suburban markets with uniform housing stock. However, these tools miss the layers that define Chicago neighborhoods. We’re talking about the varying cultures between buildings, floor plan quirks, and finish-level variations that shape real value.

When sellers anchor to automated numbers, they get stuck on a distorted view of the market. Chicago’s diversity creates opportunity, but it also creates noise. Accurate pricing requires more than math. You need context.

Why AI Pricing Models Struggle in Chicago

AI pricing works best when surrounding homes share similar structures, finishes, and histories. Chicago breaks that rule at every turn. The city’s blocks shift in tone, quality, and value in ways data cannot standardize.

A greystone sits next to a loft conversion. You’ll find dated condos sitting directly above newly renovated ones. A courtyard building with modest assessments sits across from a mid-rise with a restless board.

AI sees proximity. Humans see differences. Chicago’s market rewards the broker who recognizes micro-shifts in demand and builds culture.

When Algorithms Assume Homogeneity

Automated systems assign value based on an assumption: similar bed and bath counts within a chosen radius are comparable in value. Within a block, you might find an older condo with heavy assessments and a freshly updated two-bed with high ceilings. That same block radius could also include a warehouse conversion and a vintage walk-up with a healthy reserve account.

A human recognizes which of those will command a premium. Machines treat them as interchangeable. Experienced human agents can read beyond the radius and into the reality of how buyers rank homes.

Pricing Inside One Chicago Block

Consider a block in West Town where two listings hit the market within three weeks of each other. On paper, they look nearly identical. Both measure roughly 1,300 square feet with two beds and two baths. They also sit within a similar age range and within the same search radius.

But once you step inside, the differences are obvious. One home has eleven-foot ceilings, restored brick, designer lighting, and a full suite of premium appliances. Natural light pours in through corner exposures. The HOA is stable, and the building carries a reputation for strong management.

The other property tells a different story. Ceiling heights drop to eight feet. The kitchen has basic builder finishes. It has a dated sliding door that lets in little light. The HOA fee is triple that of the nearby unit because of planned exterior work. Buyers notice hallway wear and frequent elevator outages. The building’s reputation works against it, and local agents know it.

AI would view these as near twins. Buyers see one as a prize and the other as a project. The sale prices ultimately differed by more than eight percent. If you had relied on the automated number, you would have priced one too low or the other too high.

Why AI Struggles With Finish Levels, Condition, and Vibe

Chicago buyers appreciate thoughtful renovations, cohesive design, generous light lines, and well-managed buildings. They notice appliance brands, material quality, room proportions, and noise exposure.

Data cannot quantify the feeling of entering a space, the calm of a courtyard orientation, or the confidence of strong management. A human agent can translate these factors into the pricing logic.

How Building Reputation Shapes Value in Chicago

Building culture drives more value than algorithms assume. Thin reserves, unstable boards, frequent special assessments, inconsistent management, and high tenant ratios all influence buyer willingness. Conversely, buildings with calm governance and healthy reserves command premiums.

AI does not track any of it. Local real estate agents have professional experience with buildings and their management. That’s a powerful pricing tool AI can’t replicate.

Where AI Succeeds and Where It Fails

AI performs well in suburban markets defined by consistent construction, similar floor plans, and predictable appreciation. These systems smooth data, identify broad trends, and summarize historical patterns.

It performs poorly in mixed-condition neighborhoods, buildings with varied histories, and micro-markets where nuance drives value. Chicago displays all of these features simultaneously.

AI pricing can be a directional starting point, but it can’t tell you the full story in a place like Chicago.

How Sellers Get Misled by Automated Valuations

Many sellers trust the number printed on a screen more than the expertise presented at a kitchen table. When automated pricing runs five to ten percent high, sellers often assume the broker is conservative. They resist market reality. Time stretches and days on market climb. As the momentum weakens, they could lose time and value.

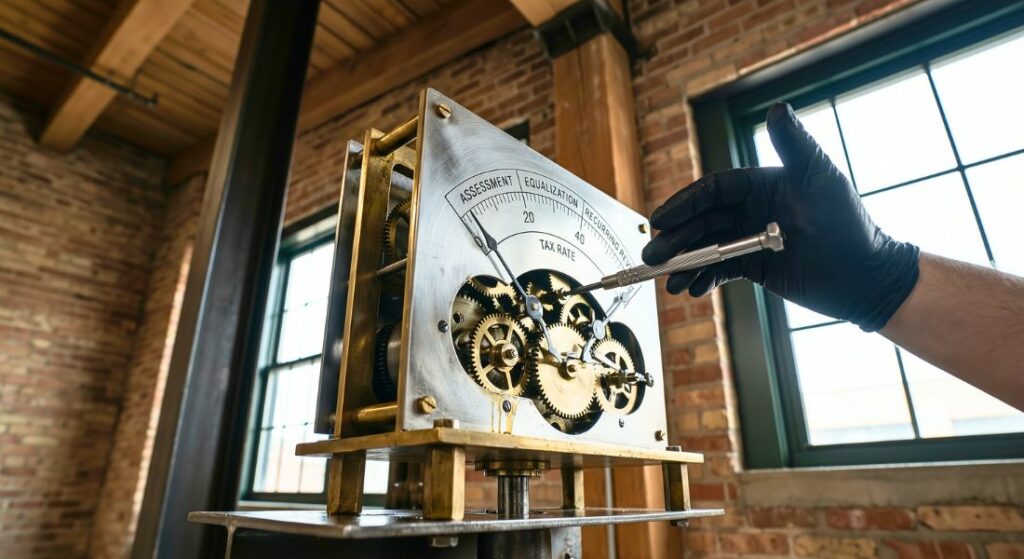

Using AI Without Letting It Lead

Smart brokers do not discard automated valuations. They put them in proper framing. AI can be a reference point. However, a good agent can demonstrate what the AI model misses. They’ll identify the finish-level premium and explain the building reputation adjustment. These factors explain pricing when AI models come up short.

Common Questions About Pricing in Chicago Real Estate

Why are automated valuations often 5–10% off (if not more) in Chicago?

Because Chicago isn’t a uniform market. Each block carries its own story with different construction eras, finish levels, HOA conditions, building cultures, and micro-trends. AI tools can’t account for these differences.

Why can’t AI adjust for building reputation or management quality?

Because algorithms measure what’s recordable, but they don’t have experience. An AI model can’t walk hallways, talk to residents, or understand the calm that comes from a well-run board.

Why do two condos on the same block sometimes sell at drastically different prices?

Because proximity does not equal comparability. AI tools treat units within a radius as essentially interchangeable. The Chicago market doesn’t behave that way. You can have two units with significant differences that don’t show up in the numbers.

How should sellers actually use AI pricing in Chicago?

Use it for context. Let AI provide the broad picture, then let a human refine it with the on-the-ground truth. A good agent will show you what the algorithm can’t see.

Humans Win Pricing in Chicago

Chicago’s market rewards intuition, local experience, and repeated exposure to micro-trends. AI cannot yet read building culture, renovation nuance, or street-level variability. The five to ten percent gap in automated pricing reflects these blind spots.

If you want more than a number on a screen, let’s connect. We’ll help you understand the micro-factors that shape these differences and what value looks like in Chicago.