Avoid these mistakes if you’re refinancing your mortgage

Refinancing your mortgage loan to one with a lower interest rate can save you hundreds of dollars each month. And refinancing might make sense today with mortgage interest rates hovering near historic lows.

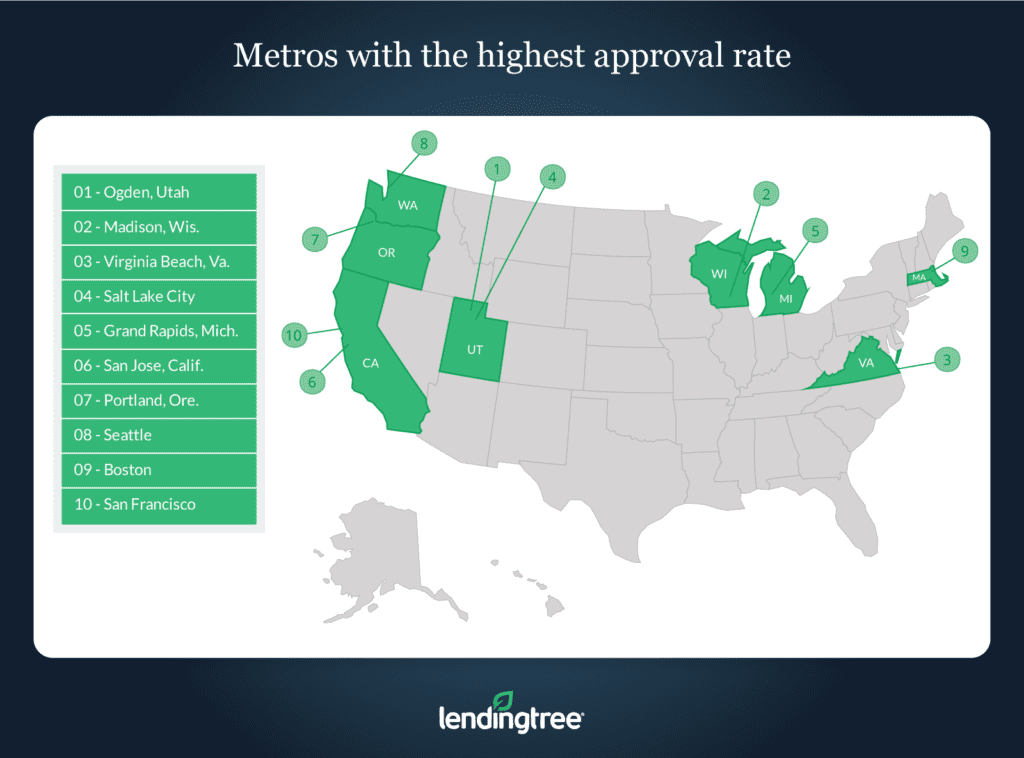

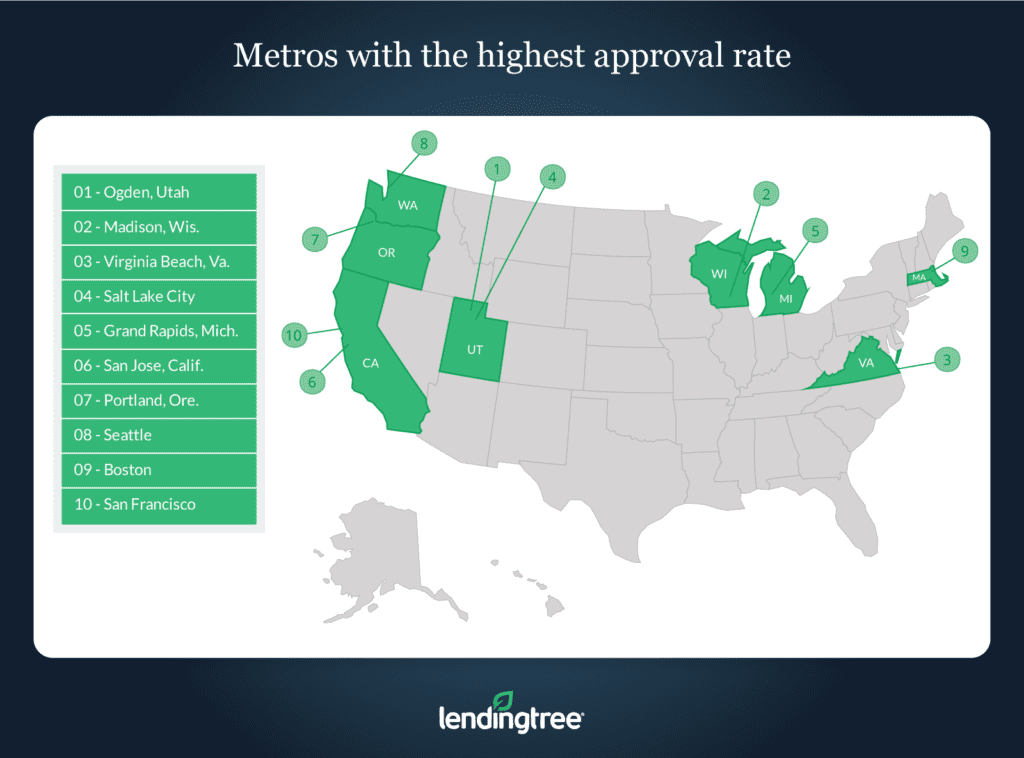

But applying for a refinance isn’t a guarantee of approval. Lenders can reject your refinance application. And a new study by LendingTree lists the most common reasons why refinances are rejected.

Some borrowers have debt-to-income ratios that are too high. As the name suggests, this ratio measures how much of your gross monthly income your monthly debts consume. If your monthly debts eat up more than 43 percent of your gross monthly income, lenders will be more likely to deny your refinance application.

Then there are credit scores. Lenders want your three-digit FICO credit score to be high. They consider FICO scores of 740 or higher to be excellent ones. If your FICO score is under 620, the odds are higher that your refinance request will be denied.

LendingTree also pointed to incomplete applications as a major reason for refi rejection. When you apply for a refinance, your lender will ask for copies of your most recent paychecks, income tax returns, W2s and bank account statements. They use these documents to verify your monthly income, something they do to make sure you can afford your new mortgage payment.

If you don’t provide this information, your lender will deny your refinance request. Lenders aren’t asking for this paperwork just to keep you busy. They’re trying to protect themselves by raising the odds that you’ll make your monthly payments on time.

Here’s another important fact to remember: Refinancing isn’t free. You can expect to pay thousands of dollars in closing and settlement costs. That’s why it’s important to make sure that the drop in your interest rate will save you enough each month to help you pay back these costs quickly. Then you can enjoy those monthly savings.