One positive here: Illinois mortgage payments are lower than the national average

The COVID-19 pandemic has resulted in a huge boost in unemployment. That can make the prospect of paying your monthly mortgage a frightening one. If COVID-19 causes you to lose your job, how will you be able to make your mortgage payment?

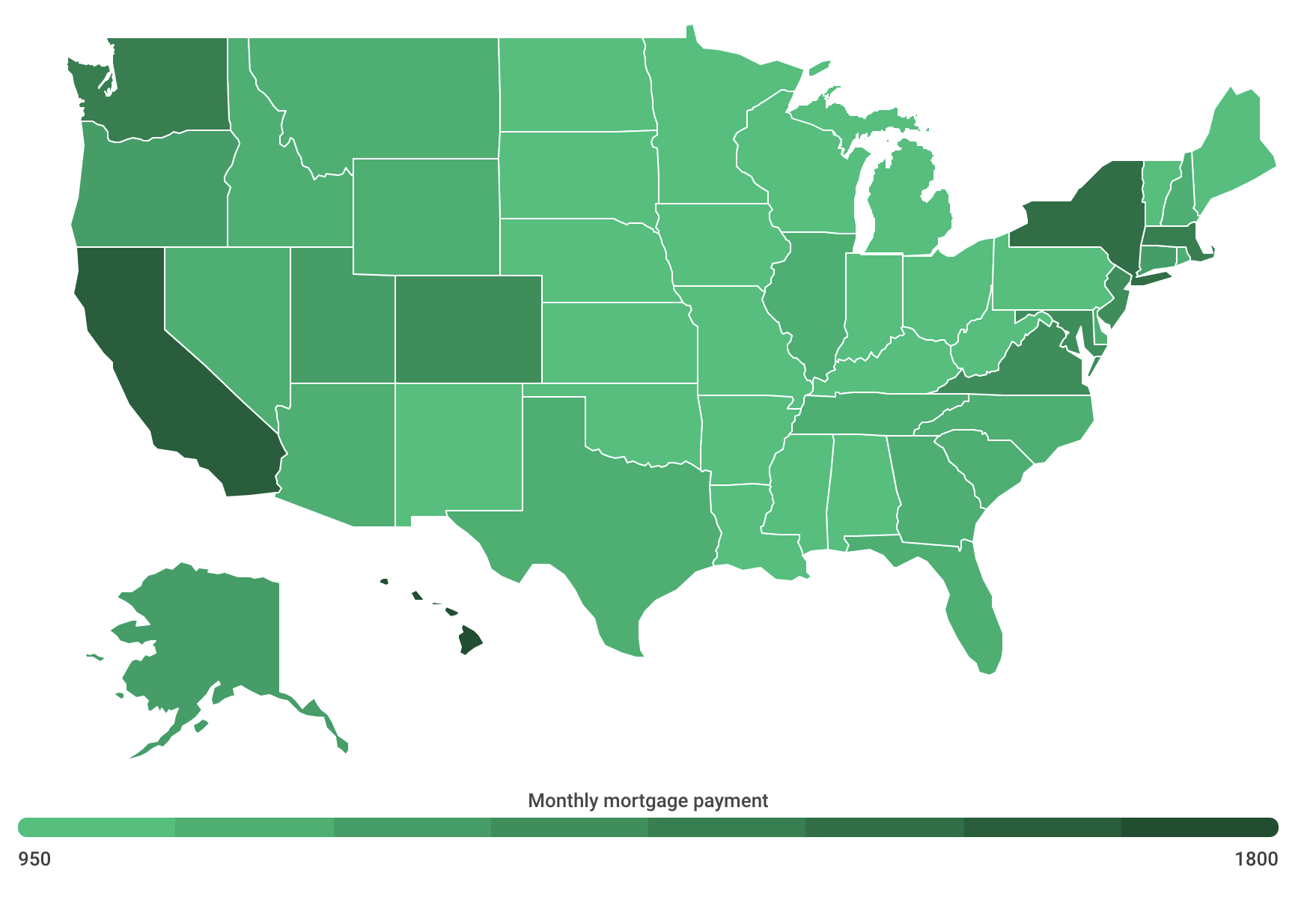

Fortunately, the average monthly mortgage payment in Illinois isn’t overly expensive when compared to the rest of the country, according to a recent study by LendingTree.

LendingTree looked at mortgage data through 2019 and found that the average monthly mortgage payment in the United States stood at $1,159. In Illinois, though, this figure was $1,130. At the same time, the average monthly household income in Illinois was $7,405.

This should provide homeowners in Illinois with a bit of a financial cushion. However, losing a job can quickly eliminate that financial safety net. If you lose your job and are now struggling to make your mortgage payment each month, you should immediately contact your mortgage lender.

This might seem counterintuitive, but it’s important to ask for help. Your lender might be willing to work with you to provide some payment relief, potentially giving you a break from making your payments as you work to rebuild your monthly income. Lenders understand what is happening throughout the country today. Most would rather work with borrowers to keep them in their homes.

And if you’re thinking of buying a home? Make sure you know how much of a mortgage payment you can afford each month. You don’t want to tax your monthly household budget. If you struggle to make your payment each month, it’s difficult to enjoy your new home. So work on that budget before you start hunting for a house. You’ll appreciate it when making that monthly payment is free of stress.